275k is not the old 275k

- 14 Junio 2024 (5 min de lectura)

Interest rate cuts are being delayed - a pattern which has been repeated many times this year. The economy is just not moving as fast as modern-day instant gratification requires. So, investors could consider staying in cash or short-duration fixed income, where the yield is attractive and well above inflation, while they patiently think about what might happen next. The US labour market is slowly easing, and inflation is slowly coming down. Unless there are some hitherto hidden forces that reverse those trends, the conditions for monetary easing will become more convincing in the months ahead. For bond investors, this does provide a potential opportunity to extend duration to profit from lower yields.

No change

Market pricing of where the Federal Reserve’s (Fed) key policy interest rate will be at the end of 2024 has been stuck in a range between 4.80% and 5.00% since the end of April. The revisions to the Fed’s ‘dot plot’ of rate projections that were published following this week’s monetary policy meeting did little to move it. Nor did the release of May’s inflation report, showing a deceleration in both headline and core Consumer Price Index (CPI) inflation to 3.3% and 3.4% respectively. According to market pricing, we will get one interest rate cut in November and potentially another in December. However, the lesson from recent months is, don’t bet on it. The economic data, and the chances of November’s presidential election result not being immediately clear, could rule out a move when the Fed meets on 6-7 November. Indeed, there is a chance of no rate cuts at all this year, with more coming in 2025 as a result. On the other hand, rates could be cut more quickly.

Avoid mistakes at all costs

Markets do not know because the Fed does not know. Most officials think the Fed should maintain a level of monetary restrictiveness because the disinflation process is slow, and the labour market is still tight. Equity markets reached new highs this week and there are no signs of weakness in credit markets, with spreads on investment grade and high yield bonds close to their recent lows. Why would the Fed cut rates now? The risk of doing so – which is something that may haunt the European Central Bank (ECB) – is that it would be a mistake and need to be reversed if the economy failed to soften and inflation stayed high. But the core view is that conditions will move in the direction of an easing cycle starting in the coming months; though the bar for making the first move is quite high for the Fed (and the Bank of England). The ECB has taken a different approach and is now subject to the data on inflation and growth behaving.

US jobs key

I have been looking at US jobs numbers because the case for monetary easing depends on the labour market cooling. The 272,000 additional non-farm payroll jobs in May were a surprise – the economists’ consensus was for an increase of 180,000 according to a Bloomberg survey. The market did not like that number – 10-year US Treasury yields jumped 14 basis points (bp) on the day. The automatic analysis is that the labour market remains hot, which risks sustaining high wage growth which, in turn, will prevent service sector inflation from coming down. Service sector inflation, excluding energy, remained at 5.3% in May. Given the weight of services in the CPI basket, if service sector inflation does not come down, the Fed will not meet its overall inflation target.

Growth slowing

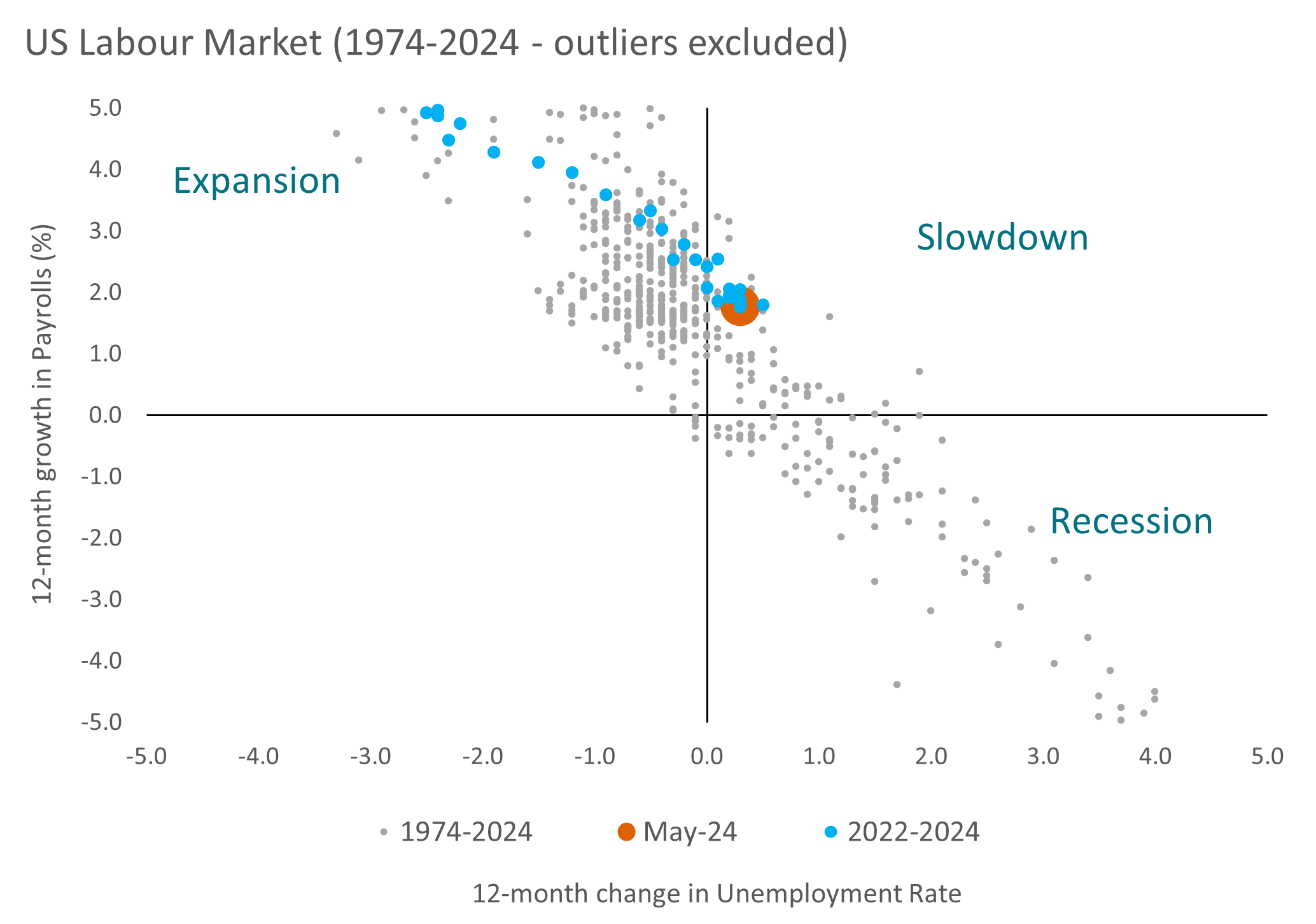

But today’s 275,000 is not what it was five or 10 years ago. What we should look at is the growth rate of jobs. The total number of non-farm payroll jobs in May stood at 158.5m. May’s number would reflect an annualised growth rate of just over 2.0% (which would have been 2.4% in May 2014 when the payroll was 138.3m). Looking at the 12-month percentage growth rate of jobs, the pace in May was 1.77%, down from 2.54% in May 2023 and 4.74% in May 2022. Jobs growth is slowing and the unemployment rate is ticking higher. In May, the rate was 0.3 percentage points higher than a year ago.

Back to normal

The labour market was massively affected by the pandemic. In March and April 2020, the US economy shed almost 22m jobs. The pandemic-related recession was short but very sharp and it took until May 2022 for all those jobs to be recovered. As the economy recovered, job creation accelerated so the growth rates were spectacular. I would argue that the jobs growth rate has only really normalised in the last year.

Part of the tightness in the labour market was a result of that rapid recovery in demand for employees, together with a reduced participation rate resulting from people leaving the labour force during the pandemic. Supply and demand were imbalanced. Immigration into the US has helped. With the recent Job Openings and Labor Turnover Survey (JOLTS) data showing a decline in job openings and weekly jobless claims data showing a modest upward trend, it does seem that labour market tensions are now easing.

Moving along

The chart below plots the 12-month change in the US unemployment rate against the 12-month percentage change in non-farm payroll jobs. As you would imagine, it is a linear relationship. The orange dot represents May 2024, and the light blue dots represent the period from the beginning of 2022. The data indicates economic slowdown and a potential recession ahead (when jobs growth turns negative and the unemployment rate is rising). Hopefully, the Fed eases significantly before we get into that bottom right-hand quadrant.

Source: DataStream

Take time

Patience is a (rare) virtue in markets. A trading mentality requires importance to be attached to every data point and market moves explained by whether economic releases were in line with expectations or not. That is bonkers. There is a lot of noise in all data series and markets are complex systems; price moves are determined by many factors with unstable coefficients. Investor success requires a patient, longer-term approach. That extends to looking at the economic data. Sure, there will be times when data is so out of line that importance should be attached to a single observation because it could spark shifts in policy or capital allocations if investor sentiment is impacted sufficiently. But in a benign environment, like the one we are in today, it is important to focus on how data moves over time. The US labour market is a case in point. It may not be weakening quickly enough for the Fed to cut rates right now but the direction appears clear. In a few months we could be seeing monthly payroll numbers of – say – between 100,000 and 150,000, representing a growth rate of less than 1%, and an unemployment rate of above 4.5%. That would definitely be rate-cutting territory.

Lower bond yields will come as the soft landing is confirmed

Short-term rates have remained higher than expected. That has rewarded cash and short-duration fixed income. This will most likely remain the case over the summer. But if the observations on job developments made in this note pan out, then the case for longer duration in bonds, looking for between 100bp-200bp of rate cuts over the next 18-24 months, becomes much stronger. If the Fed is smart, it will move quickly enough to stop an outright recession and deliver the continued soft landing, which would also be an incredibly supportive backdrop for both credit and equities.

(Performance data/data sources: Refinitiv DataStream, Bloomberg, as of 12 June 2024, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento/ material audiovisual. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 205 y 207 del texto refundido de la Ley del Mercado de Valores que se aprueba por el Real Decreto Legislativo 4/2015, de 23 de octubre.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/ o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.