Multi-Asset Investments Views: Out of Breath for Lack of Breadth

- 28 Junio 2024 (7 min de lectura)

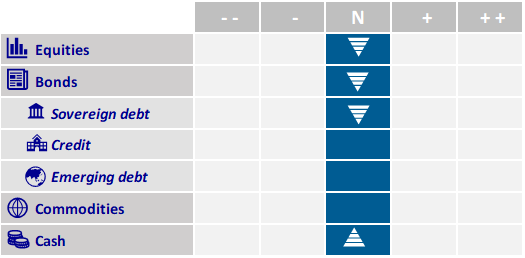

Our views

At a financial industry conference in late April, our answer to a question on the impact of the European Parliament elections was that it was “very important for Europeans, not at all for financial markets”. The past couple of weeks have been a lesson in humility. Whilst there were some surprises in the outcomes in some European Union member states (e.g. Greens in Germany, far-right in France), the heterogeneity of these surprises saw the new composition of the European Parliament ending up very much in line with projections from polls. However, one election can hide another, and the true surprise came from the local consequences of these continent-wide elections.

The ensuing market impact was rational, especially after a relatively strong risk-on start of the year: French government bond (OAT) to German government bond (Bund) spreads widened to a level last seen in 2017 when uncertainty prevailed over the two candidates qualifying for the French Presidential run-off, and related assets suffered accordingly (especially French banks). We therefore chose to reduce our exposure in both areas until we have more clarity on policy going forward and/or until market prices include enough stress premium to warrant the risk exposure.

French politics fortunately do not drive global financial markets. However, we trimmed our overweight developed equities to return to the long-term SAA exposure in our portfolios. We are not flagging a significant change in the fundamental, macroeconomic backdrop: the US GDP Nowcasting model from the Atlanta Federal Reserve (Fed) is running above +3% growth annualised, US job creations remain solid, and the latest US inflation reading was an encouraging soft surprise.

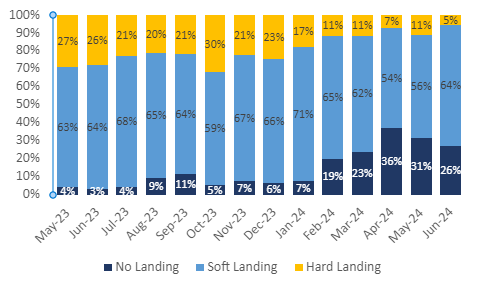

Our increased cautiousness stems from massive upwards revisions in growth expectations, whether for global and US GDP or for corporates’ earnings. At the start of the year, economists and strategists were debating between a soft, hard or no landing. Today, almost 90% of economists expect a soft landing according to a mid-June Bloomberg survey. The breadth of consensus forecast changes for the GDP growth of major global economies shot up to an all-time high in June. Growth forecasts have been revised up everywhere, leaving no space for upside surprise. Similarly, equity analysts substantially upgraded their forecasts and now expect earnings to grow strongly in the coming quarters. Basically, the Goldilocks narrative has become highly consensual (see chart below) and is now at risk of any negative surprise.

Other elements informing our more tactical prudent allocation include the optimistic to even slightly stretched investor sentiment and positioning. Meanwhile, the softening trend in the implied rate for bond volatility (e.g. visible in the Merrill Lynch Option Volatility Estimate index), which we had flagged in our May MAI Views as supportive to equity multiple expansion, recently bounced higher, whilst equity multiples have kept on expanding. In our view, this gap between rates volatility and equity multiples raises concerns for near-term market fragility.

Within our equity allocation, we also take a more defensive tilt, stepping back from our previous conviction of a broadening in the equity market rally. In particular, whilst French politics have not particularly hurt European small and mid-caps, disappointing soft data in economic surveys has reduced our short-term enthusiasm. Concentration is now extreme and this lack of breadth is unlikely to be conducive to a catch-up for weaker, higher-beta parts of the equity market.

We have also taken some profit on government bonds by reducing interest-rate sensitivity (aka duration). AXA IM’s macroeconomic view remains that some US labour market softness and modest disinflation will allow the Fed to start cutting its interest rates in September. This scenario, broadly reflected in market expectations, is however a close call, at risk of yet another delay in monetary easing in case of an upside surprise in the US consumer price index (as was the case mid-May) or in non-farm payrolls (as per early June). This fundamental assessment is corroborated by our quantitative signals, driven in part by the recent bounce in oil prices, back above $80 for Brent. We therefore consider the asymmetry of risks no longer favourable enough: we fade the rally in developed government bonds and revert to our long-term duration exposure.

Soft landing most likely outcome in line with our view: How market consensus evolved between ‘soft’, ‘hard’ and ‘no’ landing

Source: BofA Fund Manager Survey, BofA Global Research

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Fuente de la imagen: Getty Images

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.