Rising prices, higher coupons

- 28 Junio 2024 (5 min de lectura)

When I started in asset management, the chief rational for bond investing was based on the compounding of income returns. After years of price volatility and central banks’ distorting of yields, we are back to that simple mantra. Income rules right now. Of course, attention must be paid to shifting interest rate expectations, surprise policy moves, or changes in the credit environment. But higher-for-longer interest rates have benefited bonds. Older bonds approaching maturity are on a pull-to-par journey, while new bonds have higher coupons. Together this means fixed income is much more attractive.

Summer arrives

It is noteworthy that as the northern hemisphere heads towards the summer holidays, markets are characterised by lower volatility and, for a large part, returns are dominated by income. Indeed, the ratio of carry (or income) to volatility has increased in recent months because of income returns going up – especially in fixed income markets – and volatility coming down. The situation reflects the benign nature of the macroeconomic backdrop and growing confidence in a soft landing scenario where inflation continues to moderate without the need for a recession.

Higher coupons

In fixed income markets, income return has been slowly increasing, reflecting higher coupons in response to elevated interest rates since the monetary tightening cycle began in 2022. Looking at representative corporate credit bond indices, the average coupon on US dollar investment grade bonds has risen by 65-70 basis points (bp) since the beginning of March 2022. The equivalent increases are 100bp for the euro investment grade market; 40-50bp in sterling; and 60-100bp in US dollar and euro high yield bond markets. In the euro market today, around 25% of outstanding corporate issues have a coupon of less than 2% and 22% have a coupon that is higher than the current average yield to worst of 3.8%. In March 2020, 70% of outstanding bonds had a coupon of less than 2%. As rates remain higher for longer, the market coupon will increase and that means higher income returns for investors.

Higher income

Over the last 12 months, the income return from US investment grade credit was 4.6% (using ICE bond index data via Bloomberg). For the euro market it was 2.4% and for sterling, 4.8%. By contrast in 2020, the returns were 3.8%, 1.6% and 3.7% respectively. Moreover, price volatility has declined. Fixed income returns are more stable, more income-driven and are rising. While monetary tightening was a big problem for bonds – causing the worst bear market in generations – the fact that central banks have kept rates at their highs for a prolonged period has been beneficial.

Returns recovering after the shock of 2022

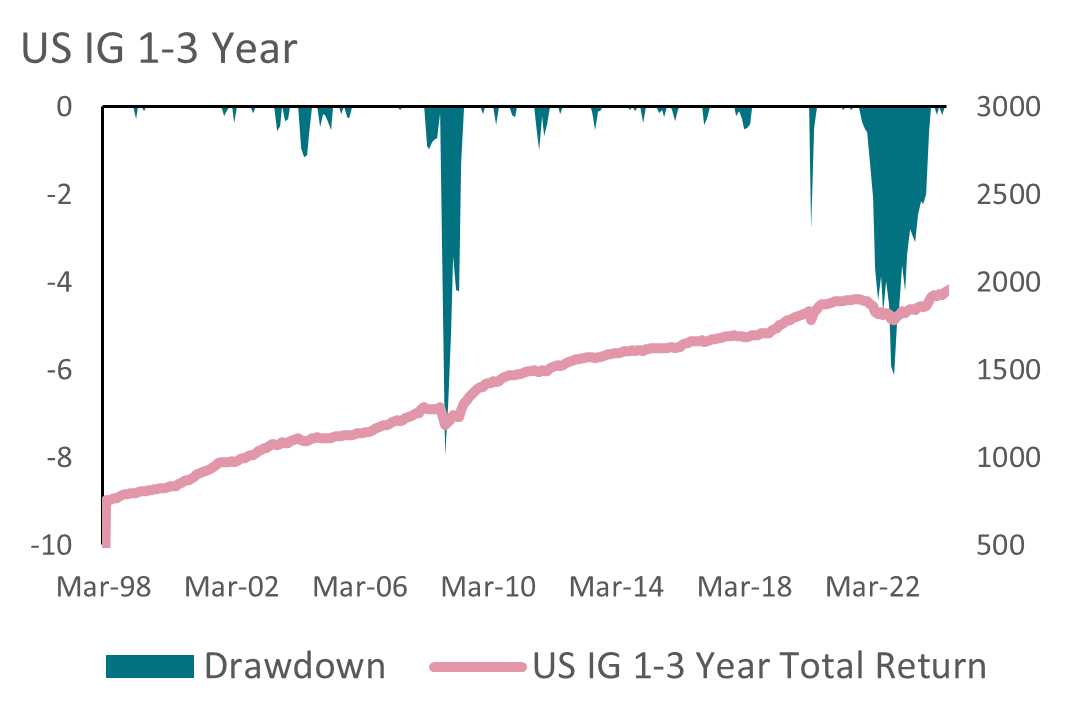

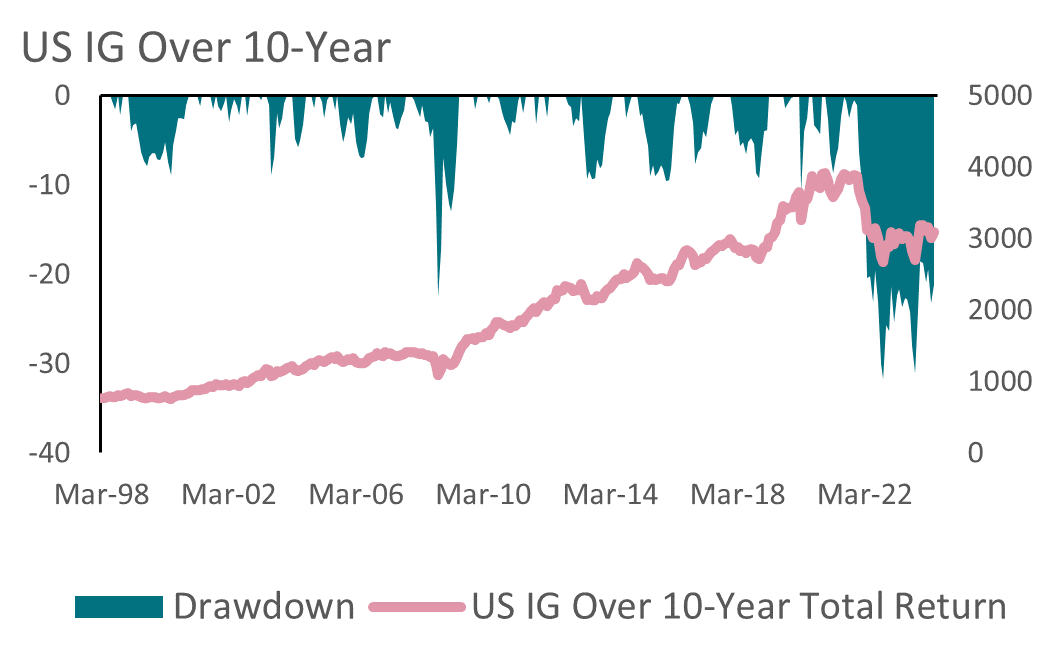

Fixed income returns are in recovery. However, 2022 was such a shock to market pricing that parts of the market are still in negative drawdown territory. The worst examples are long-duration bonds. Short-duration strategies have recovered their market value. Compare the two charts below. They show the drawdown experience of the US investment grade credit index for the one-to-three-year maturity bucket and the over 10-year bucket.

Source for both charts: Bloomberg; AXA IM

Locking in

Bonds issued before the Federal Reserve (Fed) started raising interest rates will mostly redeem at par and thus see prices increase, and those issued since have higher coupons. The combination means that fixed income returns should remain positive for the near future. For those institutional investors that favour a buy-and-maintain approach to matching bond cashflows against their liabilities, the market has not been as well set up for many years. Issuance has been strong in most corporate credit markets in 2024, giving investors plenty of opportunities to lock in yields.

Risks from spreads rather than policy

What could go wrong? For now, we can rule out higher interest rates. Europe – via the guise of the European Central Bank, the Swiss National Bank and the Swedish Riksbank – have already started the easing cycle. The Fed and the Bank of England should not be too far behind. At the very least, fears of further rate increases, which were prevalent in the spring have subsided. Lower interest rates are locked into forward markets.

Eyes on Paris

A key risk to bond markets in the near future comes from Europe. The uncertainty over France’s budget trajectory - because of the current political situation - has already led to an increase in French government bond yields relative to German yields. Market and European institutional pressure might eventually contain the policy proposals currently being discussed in the election campaign but there is a risk of spreads widening further if markets get a sniff of a new government trying to implement tax cuts or spending increases which would lead to the French public deficit moving in the wrong direction.

A more optimistic view is that cohabitation in France after the upcoming National Assembly election will constrain the more radical proposals. The spectre of what happened to UK markets in September 2022 when then-Prime Minister Liz Truss implemented a populist Budget will have not gone unnoticed in Paris. If this is the outcome, any contagion in other European government bond markets or in credit markets might be potential buying opportunities during the summer.

Credit itself looks fine

The other risk is that we begin to enter a period of generalised credit deterioration. For some time, there has been evidence from the US of increased delinquencies in areas like revolving consumer credit and credit cards, while the issues surrounding commercial real estate are well known. There have been some distressed situations in high yield as well, but, so far, these have been idiosyncratic. However, should economic data continue to soften, and a harder landing become more evident, credit risk indicators would start to flash, with spreads on cash bonds and credit default swap indices widening.

If the carry-to-volatility relationship is very benign now, it is most likely to worsen because of higher volatility on credit spreads coming from concerns about a weaker economic outlook, the corporate earnings cycle turning softer, or policy uncertainty becoming more material. The good news is none of this is evident today. Equity markets continue to perform well – even though they are skewed by technology stocks – and demand for credit remains extremely strong. The recovery in fixed income returns looks set to continue.

Summer arrives (2)

The Euro 2024 football championship looks incredibly open. So far, Spain is the only team that has won all its group games and teams like France, the Netherlands, Italy and England have been far from convincing. The knock-out stages can be quite different – and I am sure they will be. But it has been entertaining and the fans have been super. The remainder of the tournament, the beginning of Wimbledon fortnight next week and then the Olympics might be further reasons why markets stay calm until September. And while past performance does not guarantee future returns, it is perhaps worth noting that in 15 of the last 20 years there has been a positive return from the MSCI World equity index in the month of July.

(Performance data/data sources: Refinitiv DataStream, Bloomberg, as of 25 June 2024, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.