Why should investors care about biodiversity?

- 14 Enero 2025 (7 min de lectura)

KEY POINTS

Biodiversity is the variability of all living organisms from all sources, spanning all ecosystems across land and sea. It encompasses the characteristics of living systems and includes everything from the diversity within a species to the diversity between species, and of the ecosystems in which they live.

Human life and a healthy planet depend entirely on the complex interactions between living organisms in nature – interactions that sustain crops, provide clean drinking water, decompose waste, help to regulate the climate and more.

Over approximately half the world’s GDP is reliant on nature and according to one report, these so-called ‘ecosystem services’ are estimated to be worth more than US$150trn annually2 .

Fundamentally, the more intact biodiversity is, the more resilient things like food and water supply, erosion and flood control or carbon storage can be.

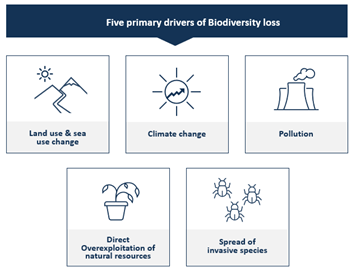

However, biodiversity on earth is deteriorating at an alarming rate, faster than any time in human history – it has been referred to as the sixth mass extinction - and this can be predominantly traced back to human-induced changes3 . Today some one million species face extinction, according to the United Nations (UN)4 .

Source: Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Service. For illustrative purposes only

- R2xvYmFsIGFzc2Vzc21lbnQgcmVwb3J0IG9uIHRoZSBJbnRlcmdvdmVybm1lbnRhbCBTY2llbmNlLVBvbGljeSBQbGF0Zm9ybSBvbiBCaW9kaXZlcnNpdHkgYW5kIEVjb3N5c3RlbSBTZXJ2aWNlcywgSVBFQlMsIDIwMTkgLyA8YSBocmVmPSJodHRwczovL3d3dzMud2Vmb3J1bS5vcmcvZG9jcy9XRUZfTmV3X05hdHVyZV9FY29ub215X1JlcG9ydF8yMDIwLnBkZiI+V0VGIE5ldyBOYXR1cmUgRWNvbm9teSBSZXBvcnQgMjAyMDwvYT4gLyA8YSBocmVmPSJodHRwczovL3d3dy53ZWZvcnVtLm9yZy9wcmVzcy8yMDIwLzAxL2hhbGYtb2Ytd29ybGQtcy1nZHAtbW9kZXJhdGVseS1vci1oaWdobHktZGVwZW5kZW50LW9uLW5hdHVyZS1zYXlzLW5ldy1yZXBvcnQvIzp+OnRleHQ9VXBMaW5rLSxIYWxmJTIwb2YlMjBXb3JsZCUyN3MlMjBHRFAlMjBNb2RlcmF0ZWx5JTIwb3Isb24lMjBOYXR1cmUlMkMlMjBTYXlzJTIwTmV3JTIwUmVwb3J0JmFtcCI+O0hhbGYgb2YgV29ybGTigJlzIEdEUCBNb2RlcmF0ZWx5IG9yIEhpZ2hseSBEZXBlbmRlbnQgb24gTmF0dXJlLCBTYXlzIE5ldyBSZXBvcnQ8L2E+

- RW1lcmdlbmNlIG9mIGEgc2l4dGggbWFzcyBleHRpbmN0aW9uPywgSm9obiBDIEJyaWdncywgQmlvbG9naWNhbCBKb3VybmFsIG9mIHRoZSBMaW5uZWFuIFNvY2lldHksIE9jdG9iZXIgMjAxNw==

- PGEgaHJlZj0iaHR0cHM6Ly93d3cudW4ub3JnL3N1c3RhaW5hYmxlZGV2ZWxvcG1lbnQvYmxvZy8yMDE5LzA1L25hdHVyZS1kZWNsaW5lLXVucHJlY2VkZW50ZWQtcmVwb3J0LyM6fjp0ZXh0PVRoZSUyMFJlcG9ydCUyMGZpbmRzJTIwdGhhdCUyMGFyb3VuZCwyMCUyNSUyQyUyMG1vc3RseSUyMHNpbmNlJTIwMTkwMCI+VU4gUmVwb3J0OiBOYXR1cmXigJlzIERhbmdlcm91cyBEZWNsaW5lIOKAmFVucHJlY2VkZW50ZWTigJk7IFNwZWNpZXMgRXh0aW5jdGlvbiBSYXRlcyDigJhBY2NlbGVyYXRpbmfigJk8L2E+

The economic and investment implications

As highlighted, more than 50% of global GDP is dependent on biodiversity – and biodiversity loss impacts all industries. All parts of the economy have some degree of dependency on nature and generate impacts through their activities. However, for the agriculture, forestry and fishing, mining and manufacturing sectors, these dynamics are the most acute. Biodiversity loss also poses economic risks linked to major fluctuations in raw material costs and disruptions to operations and supply chains. The World Bank estimates that the collapse of three ecosystem services alone – wild pollination, timber supply and fish supply – would cost 2.3% of global GDP by 20305 .

- V29ybGQgQmFuaywgMjAyMQ==

New investment opportunities

The imperative for new sustainable production and consumption models brings with it a myriad of potential investment opportunities. One way our capital can have an impact is by investing in companies that are providing solutions to biodiversity loss – through products, services and technologies which better preserve and support ecosystems. This could be in areas such as precision or regenerative agriculture, plant-based foods, sustainable packaging and water treatment.

Investors can also play a part in protecting biodiversity through impact bonds6 – bonds where the proceeds are used to tackle environmental or social challenges. The finance raised through blue bonds (which raise finance for marine and ocean-based projects) or green bonds can be used to finance biodiversity-related projects. In addition, sustainability-linked bonds may offer complementary and more widespread potential investment opportunities as this market matures.

- PGEgaHJlZj0iaHR0cHM6Ly9jb3JlLmF4YS1pbS5jb20vZ2xvc3NhcnkiPkdsb3NzYXJ5PC9hPg==

A rapidly rising priority

Biodiversity loss and global warming are interconnected systemic risks – it is impossible to address one without reference to the other. Climate change is a primary driver of biodiversity loss and will likely overtake land use change to become the largest contributor beyond 20507 .

As the UN has asserted, biodiversity remains our strongest natural defence against climate change, which has “altered marine, terrestrial, and freshwater ecosystems around the world. It has caused the loss of local species, increased diseases, and driven mass mortality of plants and animals, resulting in the first climate-driven extinctions”8 .

Ultimately, biodiversity loss is fast becoming an increasingly important part of the global agenda as public policy and the evolving regulatory landscape have upped the pressure on governments and companies to do more. For example, at the UN biodiversity conference COP15 in December 2022, countries reached a landmark agreement, adopting the Post-2020 Global Biodiversity Framework (GBF) – biodiversity’s equivalent to the Paris Agreement on climate change.

The GBF, which is also referred to as the Kunming-Montreal Agreement, sets out clear goals and a roadmap to halt and reverse biodiversity loss by 2030 to achieve a shared vision for “living in harmony with nature by 2050”. In addition, the Taskforce on Nature-related Financial Disclosures (TNFD) released its framework in 2023.

Both initiatives seek to provide consistent, comparable, and decision-useful information for businesses and financial markets. Helpfully for investors, the TNFD approach has mirrored that of the Task Force on Climate-Related Financial Disclosures (TCFD) by aiming to develop a framework for companies to disclose and manage nature-related risks and opportunities in a manner similar to the TCFD's framework for climate-related financial disclosures.

Today there is an ever-growing range of innovative technologies, processes and approaches being developed across sectors, that help companies lessen their impact on the environment and particularly on biodiversity.

For investors, it is becoming increasingly important to consider how biodiversity loss might impact long-term portfolio sustainability – namely in the form of business and market disruptions, reputational and regulatory risks, as well as the potential returns from investing in this multi-decade investment opportunity.

- R2xvYmFsIEJpb2RpdmVyc2l0eSBPdXRsb29rIDUsIENvbnZlbnRpb24gb24gQmlvbG9naWNhbCBEaXZlcnNpdHksIDIwMjA=

- PGEgaHJlZj0iaHR0cHM6Ly93d3cudW4ub3JnL2VuL2NsaW1hdGVjaGFuZ2Uvc2NpZW5jZS9jbGltYXRlLWlzc3Vlcy9iaW9kaXZlcnNpdHkiPkJpb2RpdmVyc2l0eSAtIG91ciBzdHJvbmdlc3QgbmF0dXJhbCBkZWZlbnNlIGFnYWluc3QgY2xpbWF0ZSBjaGFuZ2U8L2E+

How to invest

Even once investors have decided to integrate biodiversity into their investment portfolio, the key question becomes how to do it and in which asset class.

We see three main approaches to building a dedicated biodiversity investment strategy

- Low biodiversity footprint approaches: Investing in companies that have a limited, low or below-average impact on biodiversity through their products and/or operations

- Biodiversity solutions: Investing in companies providing solutions via their products and services that support the transition to a lower biodiversity-impact society. This is our preferred approach currently when considering listed equity investments

- Nature capital solutions which target habitat protection and restoration in private markets by investing in projects and companies protecting, restoring and sustainably managing natural capital

In addition to these very targeted approaches it is important to remember investors can already take steps to consider biodiversity across their investments via stewardship, exclusions and reporting. This is our preferred approach in fixed income, where in addition to engaging exclusion and reporting investors can consider an allocation to green bonds and in time as issuance increases to blue bonds.

Therefore, integrating biodiversity considerations into investment activities, including prioritising biodiversity-friendly investments, may be key to managing risks and contributing to positive social and environmental outcomes.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Image source: Getty Images

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.