The ‘why and how’ of integrating biodiversity into listed equity strategies

- 14 Enero 2025 (7 min de lectura)

KEY POINTS

Stemming the pace of biodiversity loss has rapidly become a critical point on the global agenda – it is a key challenge both in terms of environmental and social risks.

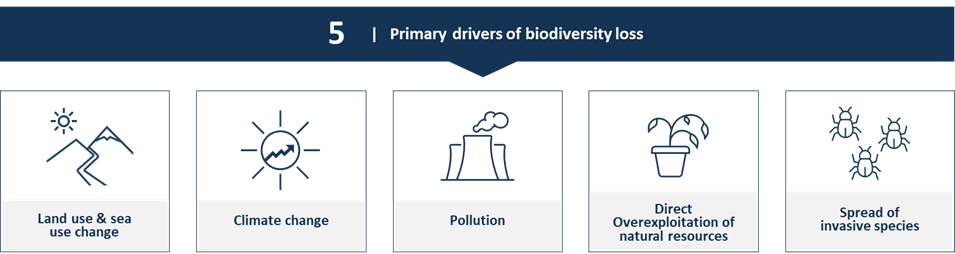

The five primary drivers of biodiversity loss are land use and sea use change, climate change, pollution, direct overexploitation of natural resources and invasive species1 - with the biggest factor how people use land and sea, including converting land cover such as forests, wetlands, and other natural habitats for agricultural and urban uses. Since 1990, around 420 million hectares of forest have been lost through conversion to other land uses2 .

Climate change is the second largest driver of biodiversity loss – limiting climate change is therefore part of the solution. Ecosystems such as forests, peatlands and wetlands represent globally significant carbon stores. Their conservation, restoration and sustainability are critical to achieving the targets of the Paris Agreement. Climate change is altering ecosystem productivity, exacerbating the spread of invasive species and changing how species interact with each other and with their environment. Climate and biodiversity are inextricably linked - there is little value in pursuing improvements in one without considering the other.

Source: AXA IM 2025. For illustrative purpose only

To address the urgent need to halt biodiversity loss, governments have adopted the Kunming-Montreal Global Biodiversity Framework (GBF), the equivalent of the Paris Agreement for climate change. The GBF aims to protect and restore 30% of all degraded ecosystems and conserve 30% of land, waters and seas, reduce food waste and cut the use of harmful pesticides by at least 50% by 2030 among other targets, with the objective of having a positive impact on biodiversity by 20503 .

Biodiversity’s increasing prominence alongside climate concerns is also reflected by the adoption of the Taskforce on Nature-related Financial Disclosures (TNFD) recommendations. The TNFD framework enables companies to conduct a double materiality assessment of impacts and dependencies, risks and opportunities related to nature. Increased nature-related disclosures will help investors to better assess the criticality of nature-related risks for society and economies based on data-driven insights.

- PGEgaHJlZj0iaHR0cHM6Ly93d3cudW5lcC5vcmcvbmV3cy1hbmQtc3Rvcmllcy9zdG9yeS9maXZlLWRyaXZlcnMtbmF0dXJlLWNyaXNpcyI+Rml2ZSBkcml2ZXJzIG9mIHRoZSBuYXR1cmUgY3Jpc2lzPC9hPiBVbml0ZWQgTmF0aW9ucyBFbnZpcm9ubWVudCBQcm9ncmFtbWU=

- PGEgaHJlZj0iaHR0cHM6Ly93d3cuZmFvLm9yZy9zdGF0ZS1vZi1mb3Jlc3RzL2VuLyI+IFN0YXRlIG9mIHRoZSBXb3JsZOKAmXMgRm9yZXN0cyAyMDIwPC9hPg==

- PGEgaHJlZj0iaHR0cHM6Ly93d3cuY2JkLmludC9nYmYvdGFyZ2V0cyI+MjAzMCBUYXJnZXRzICh3aXRoIEd1aWRhbmNlIE5vdGVzKTwvYT4gQ29udmVudGlvbiBvbiBCaW9sb2dpY2FsIERpdmVyc2l0eQ==

Investing in quality companies providing solutions to mitigate to biodiversity loss

Based on our analysis, we have identified the protection of biodiversity as key for our listed equity impact biodiversity strategy in line with the GBF. We are focusing on three solutions that will contribute to achieving the GBF’s objectives to stop biodiversity loss by 2030 and have a net positive impact on biodiversity by 2050:

- Sustainable food and agriculture - reducing the use of water, fertilisers, pesticides, and pollution while increasing food production helped by shifting consumption to meat and dairy alternatives

- Responsible production and consumption – increasing resource efficiency and reducing pollution through recycling, sustainable materials, and recirculation

- Resilient infrastructure – modernising ageing water networks to reduce water consumption and pollution, and using the latest science and technology to build next generation sustainable infrastructure designed with biodiversity in mind

In addition, we also consider the role of technology enablers – products and services that improve resource efficiency and increase environmental considerations through intelligent technology such as sensors, software and semiconductors. These can help enable companies to better monitor, assess and improve their business activities, contributing to sustainable practices and more responsible resource management.

Our investment beliefs: generating positive and measurable impact alongside financial returns

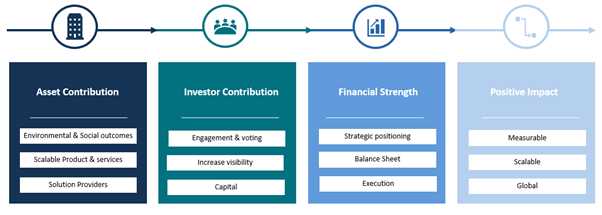

Our strategy assigns equal importance to financial returns and impact analysis. We believe that in order to generate a long-term positive global impact, companies must be financially sound, well-managed, and have strong strategic positioning. Their financial strength should allow them to leverage robust research and development and execution capabilities to generate positive, scalable impact through innovative, commercially more viable solutions and broader distribution. We believe that such high-quality companies are potentially more likely to generate strong financial returns over the long term, helping us to meet our dual objective.

Source: AXA IM 2025. For illustrative purpose only

Our core investment principle are:

- Investing in solutions

Given the urgency to halt global warming, biodiversity loss and drive social progress, we believe that investing in companies that are providing scalable, innovative products and services which help companies operating in high impact sectors to achieve these outcomes has a wider, more powerful impact compared to investing in companies which are simply improving their own footprint or complying with best practices.

- Seeking scalable, global impact

Compared to impact investment in private markets, which generates positive social or environmental change often on a local project-based level, we believe that leading listed companies can provide scalable and commercial solutions that have the potential to have a net positive impact on millions of people’s lives, or improve the environmental outcome across millions of acres of land, enacting real world change on a global level.

- Engaging to drive real-world change

We aim to engage with at least 50% of portfolio holdings. Our engagement topics are linked to our targeted social and environmental impact outcomes, and we follow up with management to monitor improvements.

- Measuring and reporting progress

We take a disciplined and transparent approach to measuring real-world change and continuously work to increase the visibility of our impact portfolios, the companies we invest in and our own contribution towards the impact outcomes we are targeting, and measure and report progress.

Defining and measuring biodiversity impact

Our definition of impact investing seeks to align with the Global Impact Investing Network (GIIN)’s framework. AXA IM is an active member of GIIN’s Working Group Advisory Committee, defining best practices of impact investing for listed equities.

Our strategy aims to generate positive measurable impact based on AXA IM’s listed equity impact framework in two primary ways. We share this with clients via our Annual Impact Report.

- Asset contribution:

Investing in listed companies which are making a net positive contribution to the strategy’s targeted social and environmental outcomes, predominantly through the products and services they provide.

Asset contribution can be measured at a company and portfolio level using impact key performance indicators (KPIs) directly related to the strategy’s targeted outcomes, such as ‘number of people benefitting from healthcare solutions’, or ‘millions of acres covered by sustainable agriculture technology’.

- Investor contribution:

Generating a positive contribution as a listed equity investor by using engagement and voting to encourage companies to increase their positive contribution to the strategy’s targeted social and environmental outcomes, set impact targets, report impact KPIs and reduce negative externalities. In addition, where possible we aim to provide additional capital through follow-on offerings and initial public offerings, and improving visibility of companies through our reporting initiatives.

Investor contribution can be measured by, for example, ‘percentage of portfolio with an engagement target related to the strategy’s targeted outcomes’, or ‘increase in the percentage of portfolio companies reporting impact KPIs’.

Listed equities provide an abundance of potential investment opportunities for investors aiming to generate positive impact on a global scale as well as to generate financial returns. Choosing an actively managed strategy from an experienced asset manager with tangible biodiversity expertise could help investors towards a mutually satisfying future for their financial goals, the planet, and the continued viability of our global economies.

Disclaimer

La información aquí contenida está dirigida exclusivamente a inversores/clientes profesionales, tal como se establece en las definiciones de los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65/UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2025. Todos los derechos reservados.

Image source: Getty Images

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.