US reaction: US payrolls in ground hog day surprise

- 07 Junio 2024 (3 min de lectura)

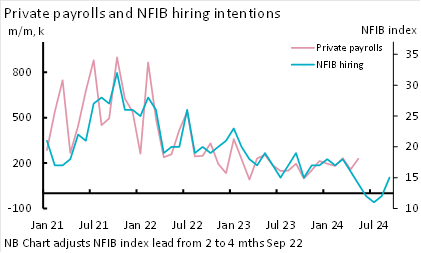

Not for the first time, we open today’s reaction with the words “Payrolls once again defied ours and market expectations”. Headline payrolls in May rose by 272k, marginally faster than the 267k average expansion over Q1. However, this was materially stronger than the 180k consensus (and our own forecast for a weaker 150k) and the downward revised 165k (from 175k) posted last month. The 3-month trend rose to 249k. Part of the increase was due to a partial rebound in government employees, those rising by 43k in May from just 7k in April, although somewhat softer than the 60k average of the previous five quarters. However, the real surprise was in the marked rise in private payrolls to 229k from 158k. This defied consensus forecasts for 165k, the 34k decline in the ADP survey and the drop suggested by the NFIB survey that has proven a remarkably good guide to private payrolls over the past 3 years (Exhibit 1).

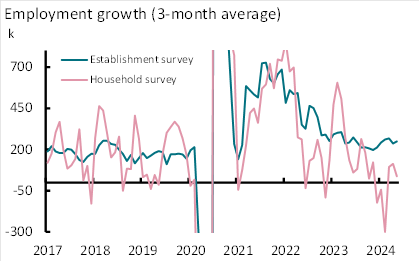

A broader view of May’s employment report starts to ask broader questions. First, the household survey measure of employment fell by 408k – its biggest one-month drop since December. We have highlighted the divergence in the two measures previously and the current divergence in trend is not as great as it has been in the past (Exhibit 2). Moreover, we argue that this series is being affected by the impact of significant immigration not yet fully captured in Census Bureau population estimates. And we know that this series is more volatile. However, the household survey captures elements that the Establishment survey only estimates in its companies births/deaths factor at this stage.

This drop pushed the unemployment rate up to 4.0% - its highest since January 2022. This was despite the fact that labour force was estimated to have contracted by 0.15% on the month, its sharpest fall this year – despite continued evidence of strong immigration into the US. This in turn reflected a 0.2ppt drop in participation to 62.5% - its joint lowest since January 2023. At 4.0% the unemployment rate is 0.6ppt higher than its latest low 13-months ago. However, the change is 0.37ppt higher in the three month average trends used to calculate the Sahm effect, which has historically been used to identify recession. Relatedly, we note that quite apart from the fall in May’s labour force, labour supply growth has been decelerating from an average annual 1.7% in 2023 to just 0.5% now. This looks questionable in the face of alternative immigration numbers that have continued to increase sharply.

Finally and perhaps most importantly, total average hourly earnings rose by more than expected, up 0.4% on the month in May (compared to a 0.3% expectation), while non-supervisory earnings rose by 0.47%, taking annual rates up to 4.1% and 4.2% respectively. The 3-month annualized rate of total earnings rose back to 4.1% in May, from the 3½ year low of 3.0% last month. We argue that 4.1% is not far from the pace consistent with the Fed’s 2% inflation target, but it is likely above it and still modestly too elevated for the Fed to consider a serious argument to loosen monetary policy just yet.

Taken in the round, today’s payrolls report raise more questions than answers and have displayed some volatile moves in most key areas. The Establishment Survey has continued to come in stronger than expected and although we continue to expect a weakening in the months ahead and hold out some expectation of downward revision to today’s preliminary figure, we do so with less conviction than before. The Household Survey remains weak, both in employment and in labour supply terms, but we acknowledge that this survey is inherently more volatile and we think impacted by population estimates. And pay growth has surprised modestly to the upside. We do not think this will have a major impact on next week’s FOMC meeting, but if anything it will urge more patience before easing policy, serving more to keep the FOMC in an uncommitted, “data dependent” mode. We expect the FOMC’s dots next week to shift to two cuts for this year and maintain our own outlook of two cuts in September and December.

Short-term rate markets reacted to the release, pricing for a September rate cut jumped from 85% this morning to 60%, with expectations for two cuts pared back to 60% from over 90%. As such, 2-year Treasury yields jumped 13bps to 4.84% and 10-year yields 12bps to 4.41%, undoing most of the steady gains Treasuries have made this week. The dollar also rose by 0.7% against a basket of currencies.

Exhibit 1: Private payrolls posts surprise gain

Source: BLS, June 2024

Exhibit 2: Divergence between two measures persists, but not at extreme

Source: BLS, June 2024

Artículos relacionados

Ver todos los artículos

UK reaction: June cut remains firmly on the cards

- por

- 09 Mayo 2024 (3 min de lectura)

US reaction: Fed unmoved on rates, tapers QT

- por

- 02 Mayo 2024 (3 min de lectura)

Eurozone data wrap-up: Path beyond June ECB rate cut remains uncertain

- por ,

- 30 Abril 2024 (3 min de lectura)

Japan reaction: Cautious stance from the BoJ

- por

- 26 Abril 2024 (3 min de lectura)

US reaction: Growth slows further, but inflation sting in the tail

- por

- 25 Abril 2024 (3 min de lectura)

UK reaction: Unemployment rises but the focus remains firmly on pay growth

- por

- 16 Abril 2024 (3 min de lectura)

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.