US reaction: CPI notches 2nd confidence builder

- 12 Junio 2024 (3 min de lectura)

CPI inflation eased again in May, the headline annual rate slowing to 3.3% from 3.4% last month, excluding food & energy the rate fell to 3.4%, which is the slowest pace of inflation in exactly three years. Importantly the monthly moves of 0% and 0.2% (0.163%) respectively were marginally softer than market expectations (0.1% and 0.3%).

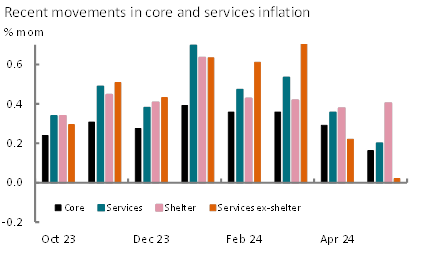

Following the upside surprises in Q1 this year, May’s release provides another month’s evidence that inflation pressures do not seem to be reaccelerating and rather at the current pace provide more evidence that they are moving back towards target. Goods price inflation softened again to an annual 0.1%, from 0.3% last month, with monthly prices falling in each of the last three months and in May helped not only by falling gasoline prices, but lower new car prices, clothing and household furnishings. Yet most focus continues around the more domestically driven services inflation (Exhibit 1). This remained more elevated at 5.2% on an annual basis, but the monthly increase slowed to just 0.2% - its slowest increase in nearly three years. Within this, shelter inflation still showed little sign of deceleration, rising by 0.4% on the month - marginally faster than last month. We believe the sampling of this measure is likely to mean that the expected deflation only materializes after next month, despite broader indicators continuing to point to deceleration. Services ex-shelter drove disinflation in this sector, rising by just 0.02% on the month – its weakest since last May. It is worth noting that the US is one of the few regions to focus on seasonally adjusted inflation figures. The fact that other statistics agencies do not adjust the data is simply a statement of the difficulty surrounding such adjustments. As such, as the Q1 shock seems to fade (and indeed unwind somewhat) over Q2, there is a persistent question as to how much of this reflected ‘seasonal variation’.

Today’s release is an important figure for the Federal Reserve (Fed). Fed commentators have used any number of descriptors for how many softer inflation readings would be necessary to build the “confidence” the Fed says it needs before easing policy. These have included “a number”, “a string” and most explicitly Fed Chair Powell stated “more than one or two”. So the release of today’s figure is likely to be still insufficient to justify the Fed easing tonight. However, we suspect that it will make the tone of tonight’s press conference somewhat easier. We expect the Fed’s dot plot tonight to switch from forecasting three cuts for this year in March to two. To our minds, this will be accompanied by cautious commentary from Powell saying the Fed still needs more confidence, but a signal of two cuts keeps the Fed’s optionality around September open in a way that moving to one would not. That is easier in the light of today’s release.

Market reaction was sharp to the release. The probability of a September cut leapt back to 80% from below 60% before the release, the chances of two cuts this year rose to 90% from 50% before. These moves basically unwound the reaction to Friday’s surprising gain in payroll jobs. Similarly, term yields also reacted, 2-year US Treasury yields falling 14bps to 4.69% and 10-year down 11bp to 4.29% - 2bps above the pre-payrolls level. The dollar also dropped by 0.6%, but this remains around 0.4% higher against a basket of currencies and 0.6% higher than the euro, reflecting increased political uncertainty.

Exhibit 1: Services ex-shelter drive figure lower

Source: BLS, June 2024

Artículos relacionados

Ver todos los artículos

China reaction: LNY seasonal volatility, divergent pressures

- por

- 11 Marzo 2024 (3 min de lectura)

ECB: Towards a (very) informed first rate cut in June

- por ,

- 07 Marzo 2024 (5 min de lectura)

China reaction: 5% GDP growth target does not erase concerns over deflation

- por

- 05 Marzo 2024 (3 min de lectura)

ECB Preview: Rate cut pondering, decision likely in June

- por ,

- 01 Marzo 2024 (3 min de lectura)

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.