US reaction: April’s softer services CPI inflation insufficient, but first step to cut

- 15 Mayo 2024 (5 min de lectura)

KEY POINTS

US CPI inflation increased by less than expected in April, the annual rate slowing back to 3.4% from 3.5% last month, with the monthly rate rising by 0.3% versus an expectation for 0.4%. Core inflation slowed in line with expectation to 3.6% from 3.8% in March, the monthly pace slowing to 0.3% after three successive upside surprises. This was superficially in contrast to the firmer than expected 0.5% monthly rise in PPI inflation yesterday, but much of the surprise strength in PPI inflation was in sectors that lay outside of CPI.

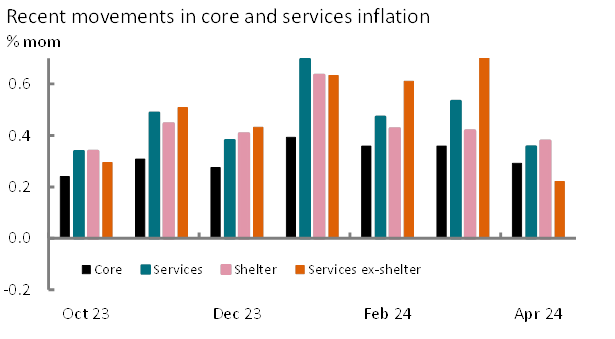

Most importantly in April was the stabilization in services CPI inflation, which remained at 5.3% on an annual basis, driven by a slowing in the monthly pace to just 0.4% - the same as last April. In turn this reflected still only modest disinflation in shelter inflation to 0.38% on the month – although in itself its weakest rate since August last year – but a more substantial softening in services ex-shelter where the monthly pace slowed to just 0.2% - its slowest pace since July – and beginning to unwind some of the stronger gains in this sector, including last month’s 0.8% monthly rise (Exhibit 1 below). Of course in 3m-annualised terms this sector still stands at an elevated 7.5%, but if services ex-shelter persist at this softer pace over the coming months this trend pace will drop quite sharply – particularly by June when March’s +0.8% drops out of the calculation. This adds to evidence that Q1 suffered some seasonal bias that may be beginning to unwind. Over the coming months annual rates will struggle to fall much further as base effects become more challenging from last year. However, insofar as the Fed has suggested that a return to ‘last summer’s’ pace of disinflation would build their confidence of returning to target – a stabilization in annual rates over the coming year would be consistent with that.

At the same time, retail sales for April came in weaker than expected. Headline sales were flat (0.0% on the month), after a downward revised 0.6% (from 0.7%) in March. The control group measure fell by 0.3% from a downward revised 1.0% (from 1.1%) last month. Expectations for retail sales had been buoyed by reports of credit card expenditure from some banks – so it remains to be seen whether this will still be captured in firmer, broader consumer spending in April. However, a slowdown is well in keeping with recent trends in consumer sentiment and is consistent with our own expectation that household real disposable income growth is set to be much slower across this year than in 2023 and in combination with saving rates already looking stretched to the downside, we expect much softer consumer spending growth over the remainder of this year.

Fed Chair Powell reminded markets in comments yesterday that he still needed more conviction that inflation was easing, but that he still expected progress over the rest of this year. Today’s print - that looks likely in combination with PPI inflation to deliver a close 0.2ppt increase in core PCE inflation later in the month – is the first piece of evidence that might continue to build the Fed’s confidence. Powell stated at the last FOMC press conference that one or two months data would be insufficient to build that confidence, but today’s release is the first step in that direction. We also think that the Fed will heed recent retail sales figures. Given the strength in February and March, consumer spending in Q2 may still remain solid overall, but the Fed will be watching for a softening in consumer spending as the final stage of deceleration for the US economy and something that will determine the type of landing the it can achieve. Finally, we will also be watching for developments in employment spending with a number of leading indicators suggesting that employment growth could continue to weaken over the coming months.

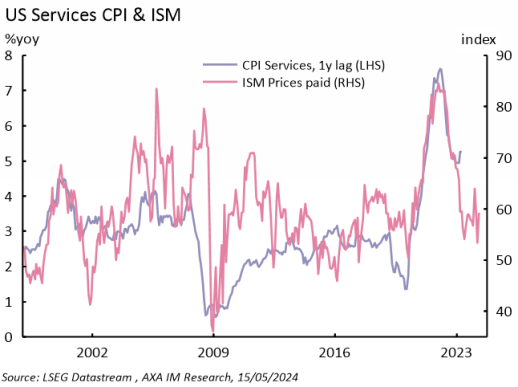

We view the combination of today’s releases as consistent with our view that the softening in US GDP in Q1 was no fluke and is likely to set the pace of expansion for coming quarters. And that inflation should show signs of more material disinflation over the coming months as upside surprises in Q1 reverse and shelter inflation continues to soften – particularly in H2 2024 (Exhibit 2). In total we see this as consistent with our outlook that the Fed will be able to begin to loosen monetary policy from September this year and our forecast for two rate cuts (taking Fed Funds Rate to 4.75-5.00%) by year-end – a view that has become almost fully priced in markets over this month from an expectation of just one cut at the end of last month.

Market reaction reflected relief in a statistic that has come to dominate monthly releases in recent months. Short-term rate pricing moved more in line with our expectation, September seeing a 3bps shift on today’s data taking the overall probability to a 92% chance of a cut in that month from 80%; the chances of two cuts this year rose 6bps to 95%. Term rates also reflected the move, 2-year and 10-year UST Treasury yields fell 5bps to 4.73% and 4.36% respectively and the dollar fell by 0.3% against a basket of currencies – now at its weakest reading for a month. Over the coming months we increasingly expect to see payroll releases regain their crown as the key monthly release.

Exhibit 1: Developments in core inflation

Source: BLS, April 2024

Exhibit 2: Services ISM points to further services disinflation

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.