The critical role of earnings surprise in equity markets and factor investing

- 25 Junio 2024 (10 min de lectura)

US investor and professor Benjamin Graham once famously said: “In the short run the stock market is a voting machine but in the long run it is a weighing machine”.

Certainly, sentiment can be a powerful driver of short-term stock market returns. But ultimately what truly matters over the long term - what actually gets weighed - are fundamentals such as book value, cash flow – and specifically, earnings.

It’s right to focus on company earnings of course but the level of delivered earnings growth is less important to the market than any actual surprise in growth - the amount by which a company surpasses, or disappoints, relative to expectations.

Fundamentally, we strongly believe in the importance of earnings surprises – analysis of which can help explain stock returns and as such it is a vital area which investors should pay attention to.

What is earnings surprise?

Brokers hire a great many analysts to write and publish detailed corporate earnings forecasts. These individual forecasts are combined to create consensus estimates on what a company is expected to earn – usually over the coming 12 months.

Compare this forecast to the level of earnings a company subsequently delivers, and the difference is the delivered earnings surprise.

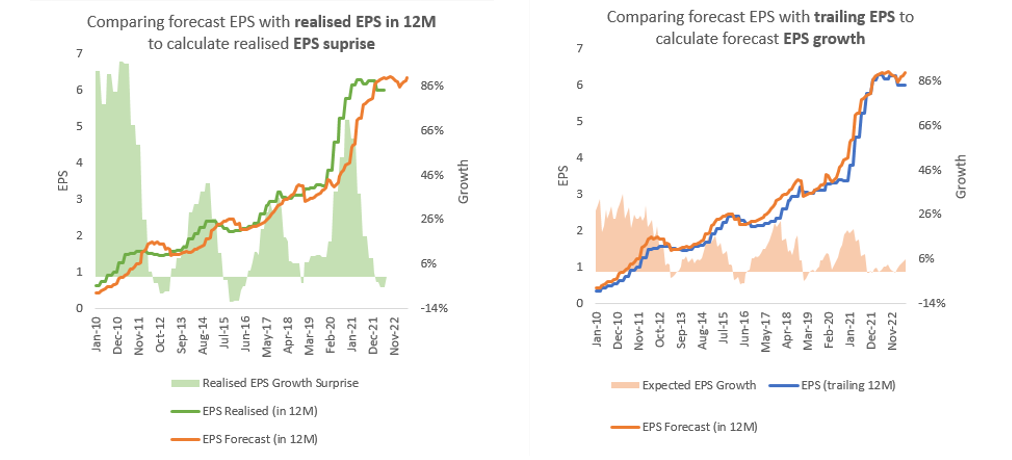

In the exhibit below, we look at how these measures of earnings growth and earnings surprise relate to a specific stock, in this case Apple. We can see analysts have consistently expected the technology giant to deliver earnings growth (left hand chart) and that the company has also consistently delivered growth higher than those expectations.

Source: AXA IM

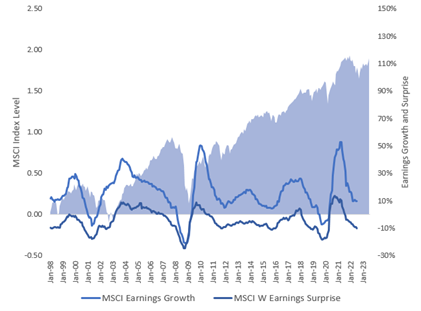

In the exhibit below, we show two measures of growth for the overall global market - realised earnings growth and earnings surprise. The key takeaway from the chart is that, on average, the market in aggregate has delivered negative earnings surprise.

A way of interpreting this observation is that the consensus expectation of future growth is too optimistic - on average when stocks report their earnings they disappoint (they deliver a negative earnings surprise) relative to expectations.

Source: AXA IM

If you could predict one thing, make it earnings surprise

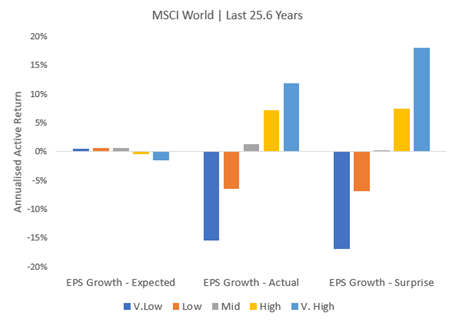

It is vital for investors in equity markets to understand the relationship between returns and three measures of earnings growth: expected growth, realised growth and earnings growth surprise.

To make this assessment, we conduct a back-test. Each month we split the universe into five equally sized buckets, based on a measure of growth. We then measure the returns of stocks in that basket. By analysing the results of this back-test we can make an assessment of the measure to see if it can predict future returns.

The chart below shows expected growth is not predictive of future returns. This is a surprising result - companies with the highest level of expected growth have actually underperformed on average.

The next two measures utilise a so-called ‘perfect foresight’ technique. Perfect foresight refers to a hypothetical ability to make predictions with complete and accurate knowledge of all future outcomes; in this case it assumes we will know today the earnings per share (EPS) all companies will deliver in 12 months’ time. We use this technique to look ahead 12 months to rank companies on the level of realised growth they deliver in earnings and earnings surprise, then measure the hypothetical return if they had bought the stock today.

As expected, stocks which deliver very high growth are well rewarded, but names that deliver very high EPS growth surprise deliver even better returns. It is important to note that within the group of companies delivering high earnings surprise, there exists a wide range of delivered earnings growth. It includes companies that deliver low levels of earnings growth. As such, if we could predict only one thing it should be earnings surprise.

Source: AXA IM

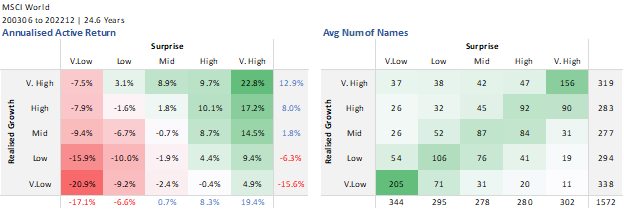

The interaction of earnings growth and earnings surprise

The chart above makes it clear how the market rewards realised surprise more than realised growth. But what happens when we look at the relationship between realised growth and realised surprise? The table below shows the annualised excess return of combinations of realised earnings surprise and realised earnings growth. Perhaps unsurprisingly, the best rewarded segment of the market is those stocks that deliver very high growth and very high surprise.

But what is more interesting is the observation that companies that deliver very low earnings growth, but beat expectations, (bottom right quadrant) outperform.

In the opposite side of the grid, companies that deliver very high growth, but are below expectations, will underperform the market. Earnings surprise is consistently rewarded by the market, but earnings growth is not.

Source: AXA IM

Expected growth and realised surprise from a sector perspective

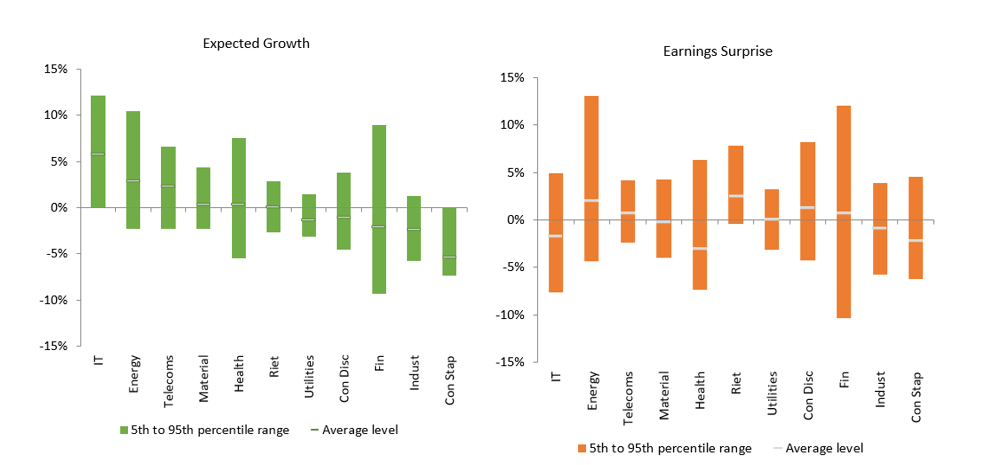

Another important observation can be made when we look at growth and surprise by industry. We can see that technology has consistently had high expectations of earnings growth relative to the overall market, and that consumer staples stocks have lower levels of growth.

What is important to note is that earnings surprise exists - and is well distributed - across all sectors. This observation makes the case for building well-diversified equity portfolios that have exposure to all market sectors. An investor looking to capture pure growth may need to have more industry concentration but an investor looking for earnings surprise needs diversification.

Source: AXA IM

What does earnings surprise mean to a factor investor?

Many investors take a ‘factor’ approach to investing – and we believe that earnings surprise is an often-overlooked part of factor investing that can have an important impact on investor returns.

Factor investing is a way of identifying and classifying the common characteristics of companies that have delivered certain patterns of return. These patterns can potentially provide insight into how stocks could be expected to perform in the future – and we believe a factor framework can play an important part of an equity investor’s approach.

Some of the most common and widely used factors by investors are: Value, Quality, Growth, Momentum and Low Volatility – asset managers can create their own definitions and models of each one.

We broadly define factors as follows:

- Value: Companies with a stock price which is relatively inexpensive compared to fundamentals, such as price-to-earnings, price-to-book value and dividend.

- Quality: Companies which have attractive levels of profitability (such as return on equity). Quality measures can also incorporate balance sheet information and measure the stability of earnings delivery.

- Growth: Companies with high historical and/or expected levels of future sales or earnings growth, typically measured over a multi-year horizon.

- Momentum: Companies which have had a positive price change relative to the market, typically measured over the previous 12 months. Momentum factors can also incorporate changes in earnings expectations.

- Low Volatility: Companies with stock prices that are relatively less sensitive to market moves, i.e., their stock beta, and/or idiosyncratic risk is lower than the market.

The reason why some equity investors, particularly quantitative investors, pay attention to factors is because over the long term each has delivered a premium return to the overall market, albeit with different levels of risk.

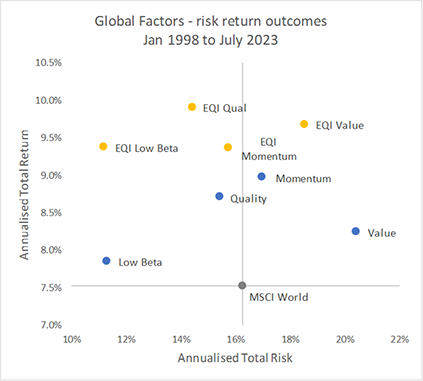

The chart below shows the risk and return profile of the most attractive 20% of stocks in the MSCI World Index ranked by the standard or ‘simple’ factor definitions as well as our proprietary factor definition (EQI).

Taking the simple factors first (blue dots), we see that over the long term they all have a return premium associated with them. The chart also shows our proprietary factor definitions (yellow dots) have been able to deliver significant improvements in return while lowering risk.

Source: AXA IM

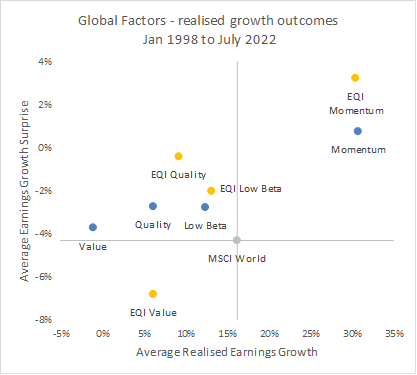

We now look at simple and proprietary factor outcomes through the prism of earnings growth. There are several key takeaways from the exhibit below. Momentum is the only factor that delivers better earnings growth than the market. All simple factors deliver better earnings surprise.

An interesting point to note is our proprietary Value factor delivers better growth but less surprise than simple Value. Although earnings surprise plays an important part in explaining factor returns, it is not all-encompassing and is not the only dimension to consider when aiming to improve investment outcomes.

Source: AXA IM

Fundamentals drive returns

We believe the impact of earnings growth and surprise should be a strong consideration when designing stock selection models for any equity investor. This is something that should not be overlooked by factor investors, as regardless of industry sector, all factors have the potential for earnings surprise.

Ultimately it all comes down to one thing - fundamentals drive equity returns in the long run. Earnings growth is important, but earnings surprise is eminent.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Fuente de la imagen: Getty Images

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.