How can investors assess and measure a company’s impact on biodiversity?

- 14 Enero 2025 (7 min de lectura)

KEY POINTS

Biodiversity loss is an existential threat to both people and the planet. However, we believe listed assets investment strategies can help deliver significant positive impacts and help stem the deterioration of the world’s fragile ecosystems.

Ensuring corporates are doing the right thing by biodiversity is vital. Thankfully policy momentum worldwide and an ever-expanding appreciation of biodiversity’s role in economies and climate change is helping drive global commitments to stop biodiversity loss by 2030, and to have a net positive impact on biodiversity from 2050 onwards.

What is being done to combat biodiversity loss right now?

A growing awareness of threats to biodiversity has propelled greater regulatory and industry efforts over time. Most recently, at the United Nations biodiversity conference COP15 in December 2022, countries reached a landmark agreement, adopting the Post-2020 Global Biodiversity Framework (GBF) – biodiversity’s equivalent to the Paris Agreement on climate change.

The GBF – also known as the Kunming-Montreal Agreement - provides all stakeholders globally with clear goals and a roadmap to halt and reverse biodiversity loss by 2030 to achieve a shared vision for “living in harmony with nature by 2050”.

It sets out 23 specific targets under four overarching goals. Among the most cited is the GBF’s so-called ‘30 by 30’ target: To conserve and protect at least 30% of the world’s land and seas by 20301 . And while expanding protected areas may mostly concern sovereigns, all actors have a role in enforcing sustainable management across the remaining 70%.

- VGFyZ2V0IDMsIHdoaWNoIGRlYWxzIHdpdGggYXJlYS1iYXNlZCBjb25zZXJ2YXRpb24uIFRoZSBHQkYgbWVudGlvbnMgdGhhdCBjb25zZXJ2YXRpb24gYW5kIG1hbmFnZW1lbnQgc2hvdWxkIGJlIGRvbmUgdGhyb3VnaCBzeXN0ZW1zIG9mIHByb3RlY3RlZCBhcmVhcyBhbmQgb3RoZXIgZWZmZWN0aXZlIGFyZWEtYmFzZWQgY29uc2VydmF0aW9uIG1lYXN1cmVz

As governments work to translate these targets into national strategies and action plans, industry momentum continues to grow. These strategies could serve as powerful catalysts, and act as a basis for enhanced synergies between governments and the private sector. Companies and financial institutions are already starting to assess their impacts on biodiversity and develop initiatives to combat biodiversity loss.

While these are still nascent, the GBF is arguably providing additional impetus through several of its targets4 that concern the private sector – calling for the integration of biodiversity across sectors, for the alignment and scaling up of financial flows, and for monitoring, assessment and disclosure.

In addition, two key international standards were issued in 2023. The Science Based Targets Network (SBTN) released beta target setting guidance which companies began pilot testing5 . In addition, the Taskforce on Nature-related Financial Disclosures6 (TNFD) published a highly anticipated framework outlining a set of disclosure recommendations and guidance for assessing, reporting and acting on nature-related dependencies, impacts, risks and opportunities.

- VGFyZ2V0cyAxNCwgMTUsIGFuZCAxOSwgYWx0aG91Z2ggb3RoZXIgdGFyZ2V0cyB0byByZWR1Y2UgdGhyZWF0cyBhbmQgYWR2b2NhdGluZyBzdXN0YWluYWJsZSB1c2UgYW5kIGNvbnN1bXB0aW9uIGFyZSBhbHNvIHJlbGV2YW50ICA=

- PGEgaHJlZj0iaHR0cHM6Ly9zY2llbmNlYmFzZWR0YXJnZXRzbmV0d29yay5vcmcvIj5TY2llbmNlIEJhc2VkIFRhcmdldHMgTmV0d29yazwvYT4=

- PGEgaHJlZj0iaHR0cHM6Ly90bmZkLmdsb2JhbC8iPlRoZSBUYXNrZm9yY2Ugb24gTmF0dXJlLXJlbGF0ZWQgRmluYW5jaWFsIERpc2Nsb3N1cmVzPC9hPg==

Measuring biodiversity

One of the most common ways to try and measure a company’s impact on biodiversity is through a biodiversity footprint. There is currently no broadly accepted metric for this7 and there are several different tools available8 . In many ways, this may reflect the complexity of biodiversity itself as well as the differing needs and applications of the institutions that use them.

At AXA IM, we use a metric called the Corporate Biodiversity Footprint (CBF), developed by Iceberg Data Lab9 . It aims to estimate the negative impact on biodiversity of a company’s economic activities, across its value chain, each year. It considers the impact from different drivers (e.g. land-use change, climate change, pollution) associated with a company’s processes, products and supply chains.

For now, the CBF measures only negative impacts, in absolute terms, and expressed spatially in square kilometres (km²) of mean species abundance (MSA) – a recognised proxy for the intactness of biodiversity compared to a pristine, undisturbed state. For example, a CBF of -100km² MSA would tell us that the pressures generated by a company’s activities during a given year are estimated to have degraded entirely the biodiversity of an area equivalent to 100km².

The CBF can be broken down by scope (1, 2 and 3, as for climate)10 and by pressure, helping to pinpoint a company’s greatest levers to act. Developments to expand the CBF’s ability to measure positive impacts as well as communicate net impacts will help to provide a more complete picture of a company’s full impact on biodiversity.

We use this metric to help us identify the sectors contributing the most to biodiversity loss as well as companies with material exposures which in turn helps us to identify companies we may want to engage with. In addition, we include the CBF in our standard environmental, social and governance reporting at portfolio level as part of our wider commitment to transparency to clients.

- UEJBRiBRJmFtcDtBOiBJbnRyb2R1Y3Rpb24gdG8gQmlvZGl2ZXJzaXR5IEltcGFjdCBBc3Nlc3NtZW50LCBQQkFGLCAyMDIy

- VGhleSBhcmUgZW51bWVyYXRlZCBpbiBGaW5hbmNlIGZvciBCaW9kaXZlcnNpdHnigJlzIEd1aWRlIG9uIEJpb2RpdmVyc2l0eSBNZWFzdXJlbWVudCBBcHByb2FjaGVz

- QVhBIElNIGhhcyBhIHNoYXJlaG9sZGluZyBpbiBJY2ViZXJnIERhdGEgTGFi

- U2NvcGUgMSByZWZlcnMgdG8gZGlyZWN0IGltcGFjdHMgZnJvbSBhIGNvbXBhbnnigJlzIG93biBvcGVyYXRpb25zIHdoaWxlIHNjb3BlcyAyIGFuZCAzIGNvdmVyIGluZGlyZWN0IGltcGFjdHMsIHdoZXRoZXIgZnJvbSBzdXBwbHkgY2hhaW5zLCByYXcgbWF0ZXJpYWxzIHVzZSBvciBjb25zdW1lciBiZWhhdmlvdXI=

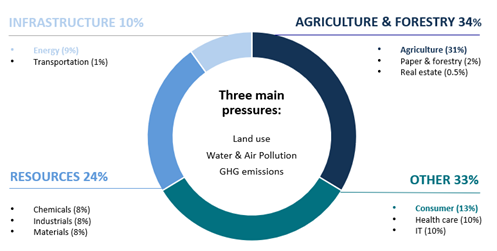

Sectors contributing most to biodiversity loss

Corporate Biodiversity Footprint of MSCI All Country World (km².MSA)

Source: AXA IM, Iceberg Data Lab as at 30/09/2023. Index use: MSCI All Country World. Corporate Biodiversity Footprint in km².MSA (Mean Species Abundance). For Illustrative purposes only.

In addition to the CBF, which we can provide across a wide range of portfolios, we also recognise the need to measure specific biodiversity key performance indicators (KPIs) for our dedicated listed equity biodiversity strategies. These are managed using our AXA IM Listed Impact Framework which consists of five pillars, one of the five being measurement which looks at company and portfolio level KPIs. Examples of KPIs include acres of sustainable farming and tonnes of waste materials collected and processed.

We also measure investor contribution by tracking the progress of our engagement activities. Recognising the importance of demonstrating these strategies are indeed having both a positive and measurable impact, we provide our investors with an Annual Impact Report.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2025. Todos los derechos reservados.

Image source: Getty Images

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.