India’s economy: A compelling growth and investment story but challenges remain

- 11 Junio 2024 (10 min de lectura)

KEY POINTS

India’s Prime Minister Narendra Modi secured another five years in office but without the overwhelming victory he had hoped for as he lost the absolute majority he enjoyed during the previous two parliamentary terms.

Markets reacted negatively when Modi’s Bharatiya Janata Party (BJP) failed to secure a stronger mandate. The concern now is that the new political environment could make it more difficult to enact necessary reforms, and policymaking drifts towards short-term populism.

Growth and improved resilience

Over the past decade, India’s economy has outperformed most major markets, expanding at an annual average rate of 6%. In 2013 India’s economy was the 10th largest in the world. By 2023, at $3.5tn, it had risen to fifth, above France and the UK.

India still only accounts for a small share of global trade but it has become more integrated in the global economy thanks to its services exports, including telecommunications, computer and information services and professional and management consulting services.

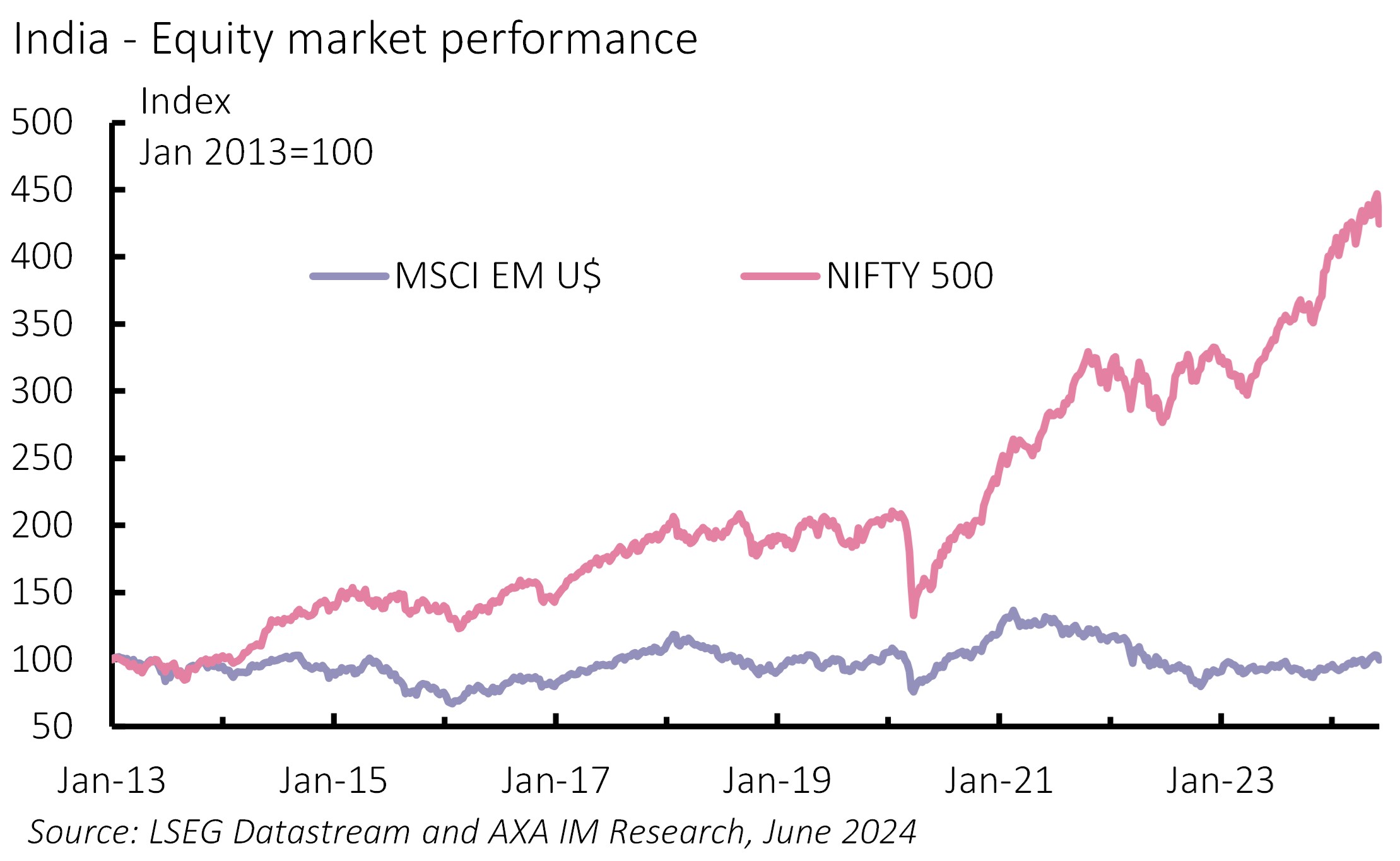

In addition, the market capitalisation of its National Stock Exchange has risen four-fold over the past decade, and the NIFTY 500 index has outperformed the MSCI Emerging Markets Index (Exhibit 1).

Exhibit 1: India’s booming capital markets

Headwinds to growth

Despite the growth and relative stability, multiple challenges remain, notably widening income inequality, rising youth unemployment, and stubbornly high food price inflation.

India now boasts the world’s largest population at 1.4 billion, surpassing China in 2022, and its population is young, with a median age of 28 years (below China’s 39 years). The failure to generate formal employment opportunities for its expanding young labour force means India is at risk of wasting this much-vaunted demographic dividend.

Despite the hubris over India’s fast-growing economy, per capita GDP is still low. In nominal US dollar terms, India’s GDP per capita stood at $2,500 in 2023 - up from around $1,500 a decade ago, but still far below other large emerging markets, such as China ($12,500), Brazil ($10,600) and South Africa ($6,100), according to International Monetary Fund data.

There has also been a widening gap in income distribution. According to the World Inequality Lab, in 2022 the top 1% of income earners had a 22.5% share of total income, while the bottom 50% had a 15% share.

India’s manufacturing sector has yet to secure a large share of global trade. In 2022, its goods exports accounted for 1.9% of the global total, up only marginally from 1.8% in 2014.

India has had greater success on the global stage on the services side. Exports of telecom, computer, information and other business services accounted for an 8.1% share of the global total in 2022, up from 6.5% in 2014, according to World Trade Organization data. This success reflects not only positive structural factors, notably its cheap and large pool of English-speaking labour, but also recent improvements in advancing India’s IT infrastructure and the evolving domestic ecosystem. India also offers lower real estate costs compared to other major cities across Asia.

A new growth model for a different world

Technological change is likely to enhance the growth potential from services. There is optimism that India is well-positioned to benefit from the impact of artificial intelligence (AI). In a 2023 study, consultancy EY estimated a substantial boost to Indian GDP from AI adoption; over seven years to 2030, it could contribute an additional 0.9% to 1.1% in annual growth.1

However, a key objective for India’s long-term development is job creation for its educated youth, and AI could create challenges in this respect, potentially diminishing the advantage that India’s demographic dividend should confer.

However, India should see strong growth in the energy transition and security front, given the huge energy requirement the country will have over coming decades, and its success so far in driving investment in renewables.

Modi 3.0 and beyond

Barring major shocks to the global economy, India’s economic expansion should continue to outpace most other major emerging markets in the next five years. A continuation of current pro-business and investment-promoting policies, combined with its growing consumer market, should keep annual growth above 6%.

Over a five-year horizon, India therefore continues to present investors with a compelling growth story, and this pace of growth could be faster if Modi manages to accelerate reform, which could unlock potential growth closer to the double-digit rates recorded by China and other East Asian economies during their acceleration phases.

However, challenges look set to grow over the longer term. India is among the most vulnerable markets to the adverse impact of climate change, notably the potential reduction in productivity from extreme heat, the damage to physical assets from extreme climate-related events, and the required diversion of resources to disaster risk management and mitigation projects.

Modi has achieved a rare political feat in winning a third consecutive term, but the decline in support compared to the previous election in part reflects his government’s failure to ensure the spoils of the growing economy are shared widely. With the BJP losing a majority, and facing a rejuvenated opposition, Modi will need to adopt a more conciliatory and consensus-building approach to policymaking to push through difficult but necessary reforms.

Download the full report below for further analysis.

- PGEgaHJlZj0iaHR0cHM6Ly9hc3NldHMuZXkuY29tL2NvbnRlbnQvZGFtL2V5LXNpdGVzL2V5LWNvbS9lbl9pbi90b3BpY3MvYWkvMjAyNC9haS1uZXdzLWxldHRlci8wNS9leS1pcy1nZW5lcmF0aXZlLWFpLWJlZ2lubmluZy10by1kZWxpdmVyLW9uLWl0cy1wcm9taXNlLWluLWluZGlhLWFpZGVhLW9mLWluZGlhLXVwZGF0ZS5wZGYiPkVZLCZuYnNwO0lzIEdlbmVyYXRpdmUgQUkgYmVnaW5uaW5nIHRvIGRlbGl2ZXIgb24gaXRzIHByb21pc2UgaW4gSW5kaWE/LCBNYXkgMjAyNDwvYT4=

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2024. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.