Navigate volatility with sustainable equities

- 28 Agosto 2023 (3 min de lectura)

Defensive to the core: navigate volatility with sustainable equities

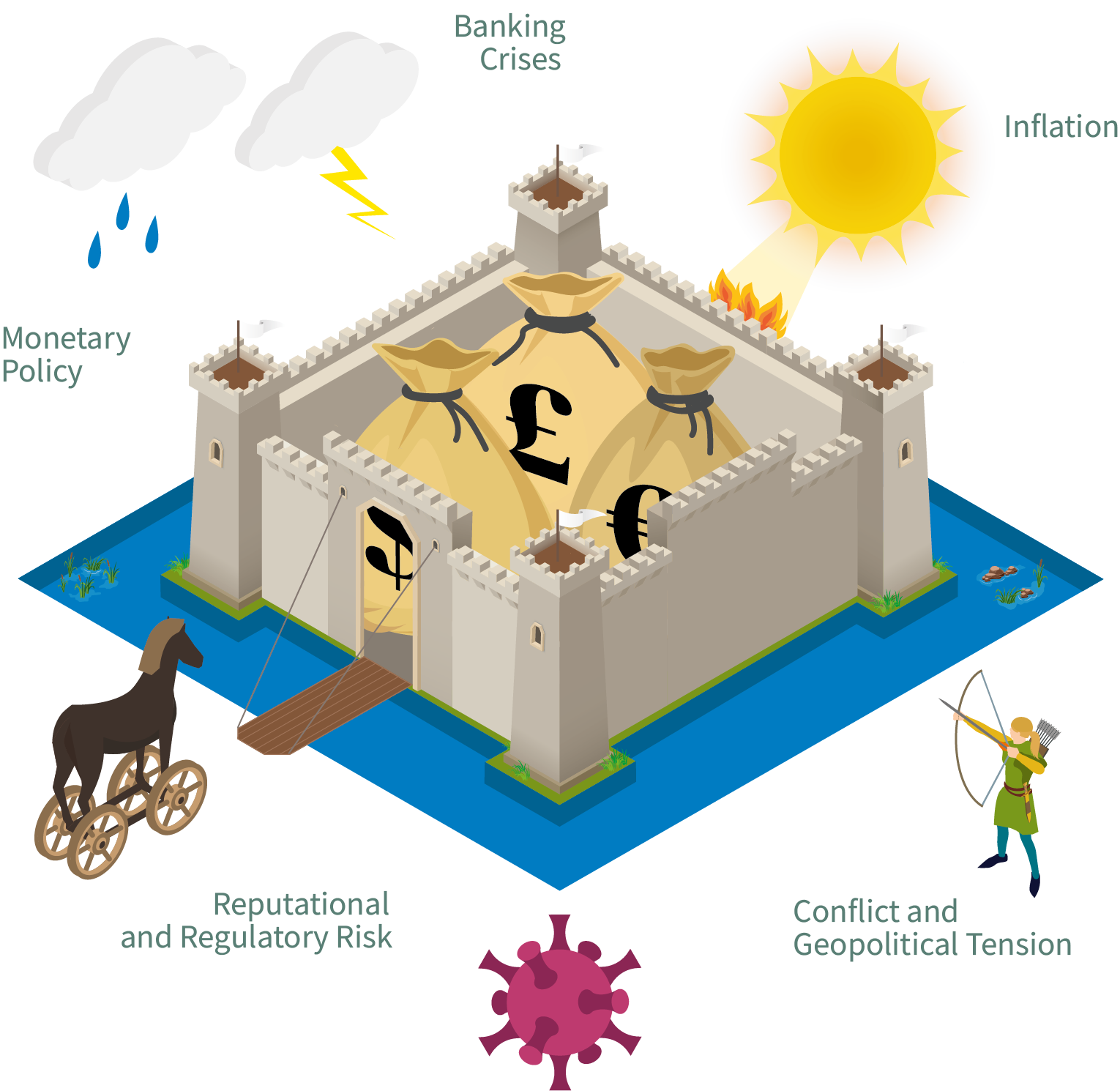

Investors today are faced with a barrage of uncertainty

How can long-term investors seek to participate in some of the growth potential associated with listed equities, whilst minimising downside participation?

Fortify your investments with advanced factor investing capabilities

A risk-adjusted, smart equity strategy can be efficiently and effectively target companies with:

High Quality |

Low Volatility |

ESG |

Sustainable Returns |

|---|---|---|---|

|

Investing in companies with high earnings sustainability may offer defensiveness in market downturns while also seeking to capture returns. |

Investing in less volatile stocks may lower a portfolio’s risk profile and reduce participation in market downturns. |

Integrated Environmental, Social, and Governance (ESG) criteria may help reduce risks and improve long-term returns. |

Targeting these factors could result in achievable, modest, repeatable returns over time. |

Cost-effective portfolio management with low turnover and managed liquidity aims to minimise the effect of adverse economic conditions across market cycles.

Sustainable equities as part of a core investment allocation could help long-term investors achieve growth goals over time

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento/ material audiovisual. La información incluida en este documento/ material audiovisual se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 205 y 207 del texto refundido de la Ley del Mercado de Valores que se aprueba por el Real Decreto Legislativo 4/2015, de 23 de octubre.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).»

© AXA Investment Managers Paris, S.A. 2023. Todos los derechos reservados.

Advertencia sobre riesgos

El valor de las inversiones y las rentas derivadas de ellas pueden disminuir o aumentar y es posible que los inversores no recuperen la cantidad invertida originalmente.